Quantitative

trading academy | £199

Quantitative

trading academy | £199

Quantitative trading academy | £199

Through our technology and partnerships, we make finance accessible to everyone, irrespective of background.

Who is this academy for?

ANY EDUCATIONAL

BACKGROUND

NO PRIOR

EXPERIENCE

ANY LOCATION

OR SCHEDULE

Who is this Programme for?

ANY EDUCATIONAL

BACKGROUND

NO PRIOR

EXPERIENCE

ANY LOCATION

OR SCHEDULE

ANY EDUCATIONAL

BACKGROUND

NO PRIOR

EXPERIENCE

ANY LOCATION

OR SCHEDULE

ANY EDUCATIONAL

BACKGROUND

NO PRIOR

EXPERIENCE

ANY LOCATION

OR SCHEDULE

Quantitative trading Overview

Asset management Overview

On-demand content & quizzes live simulation event

On-demand content & quizzes live simulation event

ASSET MANAGEMENT STRUCTURE & ROLES

Take a deep dive into all of the different roles and functions in an asset management firm.

What does each job involve and what kind of skill sets are required to excel.

INVESTMENT STRATEGIES & PROCESS

Top down vs bottom up, growth vs value, active vs passive. We detail how investment styles differ and

which client type they are most appropriate for.

CAPITAL MARKETS EXPECTATIONS

We break down the economic cycle into four phases and explore how economies and

financial asset prices typically behave in different points in the cycle.

ASSET ALLOCATION & REBALANCING

Optimising investment performance by gearing the asset allocation strategy to the economic cycle.

We also explore how fund managers rebalance their portfolios at the end of each quarter.

GLOBAL MACRO, MONETARY POLICY & ECONOMIC DATA

Exploring how changing macro conditions drive asset price trends and how to use data to track economic developments.

Understanding monetary policy and how this can significantly change asset price correlations.

EQUITY MARKETS

What are equity markets, how do their structures vary and what are the investment

strategies used in the equity asset class.

COMMODITY MARKETS

Understanding the laws of supply and demand and how this drives price change. Also,

exploring how geopolitical factors can influence supply side dynamics.

BOND MARKETS

Exploring the factors that drive bond price volatility. How does inflation and interest rates alter the

shape of the yield curve and how does credit worthiness impact ratings.

BEHAVIORAL FINANCE

Understanding how behavioural factors can have a powerful impact on sentiment.

Exploring the psychology and gains and losses and howe cognitive biases can dominate our decision making.

SIMULATION PREPARATION

Step-by-step training to prepare you to undertake your role of a portfolio management in the

advanced simulation event.

LIVE SIMULATION EVENT

Join our senior team live and online to take our advanced asset management simulation training and assessment.

Experience the same simulation as used by global financial institutions to train their new hires.

PERFORMANCE REVIEW

Receive a detailed review on your own performance to learn how to leverage your scores in your applications and interviews.

Metrics include: Return on Investment, Risk Management, Rebalancing & Risk Appetite.

INDUSTRY INSIGHTS

Join successful asset managers from across the industry to hear their top tips on how to secure and

then perform in your role.

ASSET MANAGEMENT STRUCTURE & ROLES

Take a deep dive into all of the different roles and functions in an asset management firm.

What does each job involve and what kind of skill sets are required to excel.

INVESTMENT STRATEGIES & PROCESS

Top down vs bottom up, growth vs value, active vs passive. We detail how investment styles differ and which client type they are most appropriate for.

CAPITAL MARKETS EXPECTATIONS

We break down the economic cycle into four phases and explore how economies and

financial asset prices typically behave in different points in the cycle.

ASSET ALLOCATION & REBALANCING

Optimising investment performance by gearing the asset allocation strategy to the economic cycle.

We also explore how fund managers rebalance their portfolios at the end of each quarter.

GLOBAL MACRO, MONETARY POLICY & ECONOMIC DATA

Exploring how changing macro conditions drive asset price trends and how to use data to track economic developments.

Understanding monetary policy and how this can significantly change asset price correlations.

EQUITY MARKETS

What are equity markets, how do their structures vary and what are the investment

strategies used in the equity asset class.

COMMODITY MARKETS

Understanding the laws of supply and demand and how this drives price change. Also,

exploring how geopolitical factors can influence supply side dynamics.

BOND MARKETS

Exploring the factors that drive bond price volatility. How does inflation and interest rates alter the

shape of the yield curve and how does credit worthiness impact ratings.

BEHAVIORAL FINANCE

Understanding how behavioural factors can have a powerful impact on sentiment.

Exploring the psychology and gains and losses and howe cognitive biases can dominate our decision making.

SIMULATION PREPARATION

Step-by-step training to prepare you to undertake your role of a portfolio management in the

advanced simulation event.

LIVE SIMULATION EVENT

Join our senior team live and online to take our advanced asset management simulation training and assessment.

Experience the same simulation as used by global financial institutions to train their new hires.

PERFORMANCE REVIEW

Receive a detailed review on your own performance to learn how to leverage your scores in your applications and interviews.

Metrics include: Return on Investment, Risk Management, Rebalancing & Risk Appetite.

INDUSTRY INSIGHTS

Join successful asset managers from across the industry to hear their top tips on how to secure and

then perform in your role.

What is the live Simulation event?

What is the live Simulation event?

Performance feedback

Performance Feedback

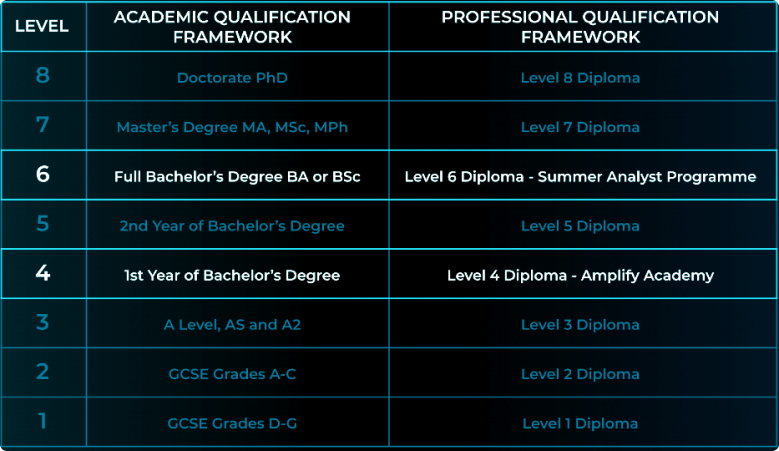

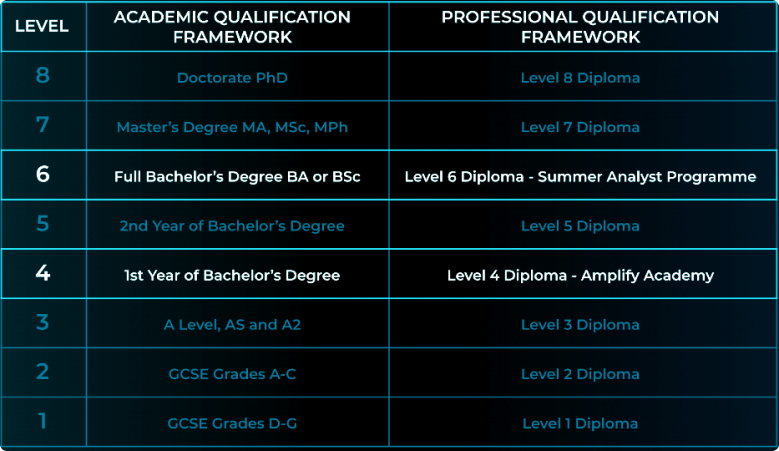

Accredited qualification

Accredited qualification

Portfolio Manager

Portfolio Manager Construct global macro portfolio

Construct global macro portfolio