Jackson Hole:

Navigating the Decade Ahead.

25 AUG 2020 | Careers

Summary

Current mandate

The Federal Reserve's mandate is stable inflation and low unemployment. High inflation causes problems for an economy as high prices for goods eventually cause stalling demand; and low inflation also causes demand to stall as consumers wait to buy at a lower price; both, leading to recession. The central bank keep inflation stable with monetary policy, when inflation is rising fast they tighten monetary policy to slow growth, slowing inflation; when the economy is shrinking (dis-inflationary environment) the bank will loosen monetary policy to speed up economic growth.

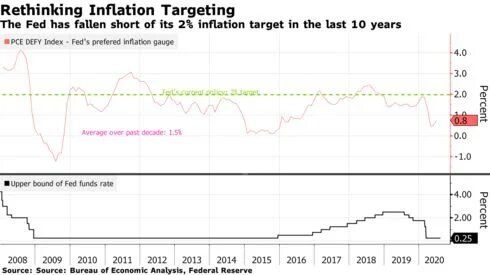

Over the last decade the mandate has been to keep inflation at 2.00%, however inflation has been persistently below the target, averaging 1.50% over the last decade. This presents a problem for the Fed, at a time when interest are at the effective lower bound and cannot go any lower. The Fed's mandate has been under review, with members debating the next course of action for the next decade, as the current mandate has failed.

This is why Jackson Hole and the September 16th FOMC meeting will be closely watched by practitioners.

Interest rates and the economy

It's important to understand the relationship between interest rates and the economy. Capitalist economies are credit driven economies, when credit is plentiful the economies grow fast as businesses and households can borrow more than they earn to invest and grow faster, stimulating the economy. Credit turns to debt of course, and growth turns to inflation, in response to inflation the central bank will raise interest rates which makes the cost of servicing the debt more expensive.

Companies borrow most from private investors and bond markets. Bonds give the investor their money back and receive an interest payment for the investment. For the company this is a debt and the interest payment is the debt charge. Company bond interest rates are priced above government bond interest rates, as the risk of default is higher for the company than the government. So the government interest rates are the benchmark. Bonds can be sold with varying duration, from over-night to 30 years, and beyond.

As interest rates rise across all duration, this will have the effect of tightening financial conditions as the cost for businesses and households to borrow money will become more expensive and will borrow less. If interest rates across the duration falls, credit is cheaper and the public will borrow more. The Fed control the over-night lending rate which will ripple across the other duration bonds and also effect company bonds. This is key in understanding why the Fed use forward guidance to "keep interest rateS, with an S, across all duration low", to support credit and lending helping to stimulate the economic recovery.

Forward guidance

Remember the Fed minutes and why we saw hawkish price action, was because the Fed members failed to make any meaningful progress towards a consensus for Forward Guidance (FG). FG will strengthen the Fed's commitment to keep interest rates low and tie rate hikes to either a) calendar based outcomes or b) economic based outcome or c) mixture of the two.

Calendar based FG was used in 2011:"FOMC announces will keep rates exceptionally low levels until mid-2013".

In 2012: The FOMC replaces "at least through mid-2013" with "at least through late 2014". Can see how the Fed kicks the can down the road with calendar based FG. The idea behind FG is to communicate to the market that the Fed will not raise rates until XYZ, there-by keeping rates low.

Economic based outcomes include: a) inflation targets or b) unemployment targets or a mixture. Fed's stance through the recent cycle was to raise rates when inflation reached 2.00%

To see the impact of Forward Guidance here's some examples:

March-18th 2009 -- The FOMC replaces "for some time" with "for an extended period" in it's post meeting statement. Interest rates fell across the board, stocks rose, and the US Dollar fell. Yields falling will stimulate the economy buy making credit cheaper, which is the Fed's aim. Notice the fall in yields was short lived, and yields started climbing again the next day and over the subsequent months, the Fed would of been worried about this tightening credit and stalling the economy.

- Jackson Hole meeting begins on Thursday and lasts until Friday. Powell speaks on Thursday 14:00 BST. Where market participants will be awaiting any updates on the long awaited Framework Review.

- If consensus towards Forward Guidance (FG) and Average Inflation target (AIT) has made significant progress, in preparation for September-16th FOMC meeting, will likely see a dovish price reaction. USD lower, equities higher and yields lower, gold higher.

- If no progress has been made, as was case in the minutes, will likely see the opposite, hawkish price reaction.

Current mandate

The Federal Reserve's mandate is stable inflation and low unemployment. High inflation causes problems for an economy as high prices for goods eventually cause stalling demand; and low inflation also causes demand to stall as consumers wait to buy at a lower price; both, leading to recession. The central bank keep inflation stable with monetary policy, when inflation is rising fast they tighten monetary policy to slow growth, slowing inflation; when the economy is shrinking (dis-inflationary environment) the bank will loosen monetary policy to speed up economic growth.

Over the last decade the mandate has been to keep inflation at 2.00%, however inflation has been persistently below the target, averaging 1.50% over the last decade. This presents a problem for the Fed, at a time when interest are at the effective lower bound and cannot go any lower. The Fed's mandate has been under review, with members debating the next course of action for the next decade, as the current mandate has failed.

This is why Jackson Hole and the September 16th FOMC meeting will be closely watched by practitioners.

Interest rates and the economy

It's important to understand the relationship between interest rates and the economy. Capitalist economies are credit driven economies, when credit is plentiful the economies grow fast as businesses and households can borrow more than they earn to invest and grow faster, stimulating the economy. Credit turns to debt of course, and growth turns to inflation, in response to inflation the central bank will raise interest rates which makes the cost of servicing the debt more expensive.

Companies borrow most from private investors and bond markets. Bonds give the investor their money back and receive an interest payment for the investment. For the company this is a debt and the interest payment is the debt charge. Company bond interest rates are priced above government bond interest rates, as the risk of default is higher for the company than the government. So the government interest rates are the benchmark. Bonds can be sold with varying duration, from over-night to 30 years, and beyond.

As interest rates rise across all duration, this will have the effect of tightening financial conditions as the cost for businesses and households to borrow money will become more expensive and will borrow less. If interest rates across the duration falls, credit is cheaper and the public will borrow more. The Fed control the over-night lending rate which will ripple across the other duration bonds and also effect company bonds. This is key in understanding why the Fed use forward guidance to "keep interest rateS, with an S, across all duration low", to support credit and lending helping to stimulate the economic recovery.

Forward guidance

Remember the Fed minutes and why we saw hawkish price action, was because the Fed members failed to make any meaningful progress towards a consensus for Forward Guidance (FG). FG will strengthen the Fed's commitment to keep interest rates low and tie rate hikes to either a) calendar based outcomes or b) economic based outcome or c) mixture of the two.

Calendar based FG was used in 2011:"FOMC announces will keep rates exceptionally low levels until mid-2013".

In 2012: The FOMC replaces "at least through mid-2013" with "at least through late 2014". Can see how the Fed kicks the can down the road with calendar based FG. The idea behind FG is to communicate to the market that the Fed will not raise rates until XYZ, there-by keeping rates low.

Economic based outcomes include: a) inflation targets or b) unemployment targets or a mixture. Fed's stance through the recent cycle was to raise rates when inflation reached 2.00%

To see the impact of Forward Guidance here's some examples:

March-18th 2009 -- The FOMC replaces "for some time" with "for an extended period" in it's post meeting statement. Interest rates fell across the board, stocks rose, and the US Dollar fell. Yields falling will stimulate the economy buy making credit cheaper, which is the Fed's aim. Notice the fall in yields was short lived, and yields started climbing again the next day and over the subsequent months, the Fed would of been worried about this tightening credit and stalling the economy.

August-09th, 2011: The FOMC announces it will likely keep the Federal Funds Rate (FFR) at exceptionally low levels "at least through mid-2013".

Here yields were already falling in to the FOMC likely as traders were betting on the FOMC enhancing guidance prior to the meeting. After the meeting yields continued to fall, stocks made a floor over the subsequent few months before rallying higher, the USD initially fell but rallied in September.

Here yields were already falling in to the FOMC likely as traders were betting on the FOMC enhancing guidance prior to the meeting. After the meeting yields continued to fall, stocks made a floor over the subsequent few months before rallying higher, the USD initially fell but rallied in September.

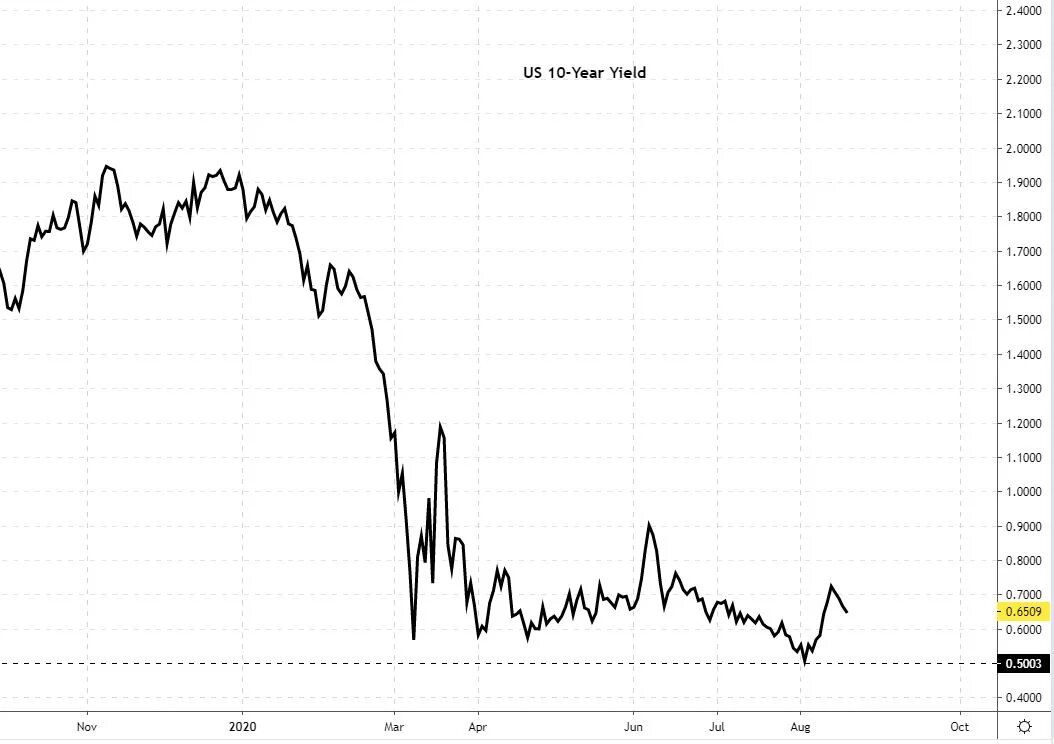

Pre-2008 recession the 10-year yield has a high of 4.00%, and post the recession the Fed did a great job on balance of reducing yields lower, and keeping yields low despite three minor sharp rises, one post the recession in 2009 in the post recession "re-inflationary period", in 2010 the Fed had the problem that yields were too high at 4.00% and in 2011 the Fed used forward guidance to force interest rates lower to support the post-2008 recession, doing a great job throughout 2011/12.

Present

Yields are low currently. which is good and shouldn't worry the Fed too much. But if the Fed do not issue explicit FG then yields could start to rise sharply, which would could threaten the post-covid economic recovery. So the Fed may want to get ahead of this by issuing FG in September. Yields could fall on the announcement, it's difficult to know how much of this is already priced, but at least for yields upside would be limited. The USD would likely fall and stocks would rise.

Average inflation targeting (ait)

During the intro we saw the fed's current problem, that average inflation is persistently below 2.00% target. One of the options being debated at the Fed is AIT. If interest rates are at the effective lower bound it becomes difficult to stimulate inflation if rates are unable to move lower, if rates are expected to bounce off the effective lower bound in the future this could cause deflation expectations which could inhibit growth.

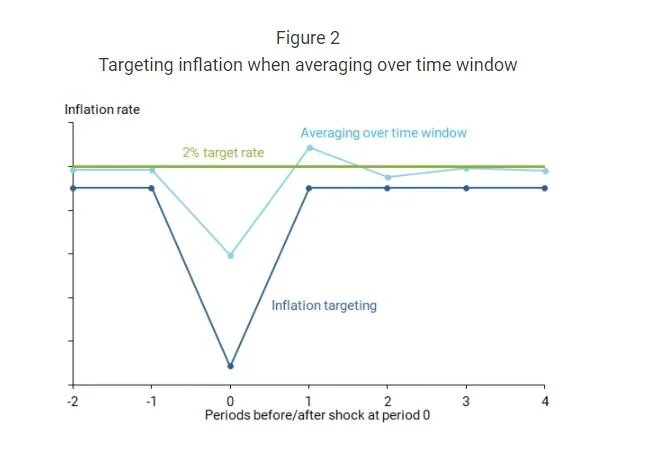

"Based on the model in Mertens and Williams (2020), the dark blue line fin Fig2 illustrates this inflation response following a onetime negative shock for a central bank with a 2.00% inflation target. Under inflation targeting, the negative shock pushes inflation below target for one period, as policy makers constrained by the effective lower bound, are unable to offset the shock. households and businesses then anticipate below target inflation on average therefore set their expectations below 2.00%". - Federal Reserve

Yields are low currently. which is good and shouldn't worry the Fed too much. But if the Fed do not issue explicit FG then yields could start to rise sharply, which would could threaten the post-covid economic recovery. So the Fed may want to get ahead of this by issuing FG in September. Yields could fall on the announcement, it's difficult to know how much of this is already priced, but at least for yields upside would be limited. The USD would likely fall and stocks would rise.

Average inflation targeting (ait)

During the intro we saw the fed's current problem, that average inflation is persistently below 2.00% target. One of the options being debated at the Fed is AIT. If interest rates are at the effective lower bound it becomes difficult to stimulate inflation if rates are unable to move lower, if rates are expected to bounce off the effective lower bound in the future this could cause deflation expectations which could inhibit growth.

"Based on the model in Mertens and Williams (2020), the dark blue line fin Fig2 illustrates this inflation response following a onetime negative shock for a central bank with a 2.00% inflation target. Under inflation targeting, the negative shock pushes inflation below target for one period, as policy makers constrained by the effective lower bound, are unable to offset the shock. households and businesses then anticipate below target inflation on average therefore set their expectations below 2.00%". - Federal Reserve

"By contrast, AIT frameworks alleviate downward pressures on inflation and output thus anchor inflation inflation expectations closer to, or even at, the target (see Mertens and Williams 2019). To make up for the undershooting during lower-bound episodes, these frameworks overshoot target at other times. An important aspect of these frameworks is their reliance on the promise to keep interest rates lower than in standard inflation targeting; this is designed to push inflation above target following periods when policy makers are constrained by effective lower bound". -- Federal Reserve.

Notice in the picture above that when inflation reaches 2.00% the Fed hike interest rates. AIT means the Fed will allow inflation to overshoot 2.00% for a period of time, maybe to 2.50% before they think about raising rates. The idea is that this will make up for times when inflation was below target and raise the average over the next decade to 2.00%. further details on exact integers are not yet available.

Much we still don't know like the finer details on how far and for how long the fed will allow inflation to overshoot. And there's a risk of course that they lose control and/ or credibility in the process.

This is a similar tool to FG, aims to keep interest rates low through communication to the public.

Market impact: If this is implemented, will signal to the market that rates will be low for a lot longer, rates will remain low even when inflation hits 2.00%, which will have dovish market reaction: bearish yields, bullish stocks, bearish USD.

Yield curve control

In short, as the economy improves and inflation rises, interest rates across duration's will rise. Longer dated bond yields are more sensitive to inflation.

Post-recession the government issue's bonds in massive volumes to raise money it can inject in to the economy, putting downwards pressure on bond prices due to supply outweighing demand, forcing yields higher. As interest rates rise it becomes more expensive for the government to service it's debt.

If yields rise, the Fed can use Quantitative Easing (QE) to buy specific duration's of bonds to drive the price up and force the yields lower. This is another tool being discussed at the Fed. But in the July minutes stated: "Most members agreed that YCC would only provide modest benefits in the current environment (of low yields)". But would "reassess YCC as a policy tool if the conditions changed". Basically closing the door on YCC in the near term.

In order for the Fed to implement YCC we'd need to see yields rise significantly from where they're currently, something like what we saw in 2013 where yields rose from 1.50% to 3.00% over four month period. For now, the yield on the 10-year sits comfortably around 0.60% and both times in recent months yields have tried to rally, they've fallen back.

US 10 year, Yield:

Much we still don't know like the finer details on how far and for how long the fed will allow inflation to overshoot. And there's a risk of course that they lose control and/ or credibility in the process.

This is a similar tool to FG, aims to keep interest rates low through communication to the public.

Market impact: If this is implemented, will signal to the market that rates will be low for a lot longer, rates will remain low even when inflation hits 2.00%, which will have dovish market reaction: bearish yields, bullish stocks, bearish USD.

Yield curve control

In short, as the economy improves and inflation rises, interest rates across duration's will rise. Longer dated bond yields are more sensitive to inflation.

Post-recession the government issue's bonds in massive volumes to raise money it can inject in to the economy, putting downwards pressure on bond prices due to supply outweighing demand, forcing yields higher. As interest rates rise it becomes more expensive for the government to service it's debt.

If yields rise, the Fed can use Quantitative Easing (QE) to buy specific duration's of bonds to drive the price up and force the yields lower. This is another tool being discussed at the Fed. But in the July minutes stated: "Most members agreed that YCC would only provide modest benefits in the current environment (of low yields)". But would "reassess YCC as a policy tool if the conditions changed". Basically closing the door on YCC in the near term.

In order for the Fed to implement YCC we'd need to see yields rise significantly from where they're currently, something like what we saw in 2013 where yields rose from 1.50% to 3.00% over four month period. For now, the yield on the 10-year sits comfortably around 0.60% and both times in recent months yields have tried to rally, they've fallen back.

US 10 year, Yield:

US 10 year, Present:

QUANTITATIVE EASING

"Several" participants suggested that additional accommodation could be required, but it seems that the majority are satisfied in waiting for more information. If infection rates continue falling in the US, there may be less urgency to add to the monetary policy stimulus.

On the QE front, as well as adopting AIT and explicit FG in the policy statement, there is a good chance that the Fed will reinforce those changes by increasing the pace of QE. This would be more dovish.

Conclusion

If FG is implemented this will be the next step for the dovish trend across asset classes, and if not then would see the opposite reaction. It's unlikely Fed will implement anything at Jackson Hole given the lack of progress towards consensus at the July FOMC.

Therefore it's the same trade as the minutes, any indications of progress towards consensus on the Framework Review. Serious progress towards consensus will make policy implementation more likely at the September meeting, the market would move now on that not in September.

For maximum dovish reaction would want to see both FG and AIT, FG and delayed AIT could be interesting, FG and no AIT could be viewed as hawkish potentially with YCC off the table. I'd want to watch how the market digests those final two scenarios as my conviction is a lot less. Any further QE would be welcomed as always, although that's not the big driver here.

Amir Khadr - Head of Technology"Several" participants suggested that additional accommodation could be required, but it seems that the majority are satisfied in waiting for more information. If infection rates continue falling in the US, there may be less urgency to add to the monetary policy stimulus.

On the QE front, as well as adopting AIT and explicit FG in the policy statement, there is a good chance that the Fed will reinforce those changes by increasing the pace of QE. This would be more dovish.

Conclusion

If FG is implemented this will be the next step for the dovish trend across asset classes, and if not then would see the opposite reaction. It's unlikely Fed will implement anything at Jackson Hole given the lack of progress towards consensus at the July FOMC.

Therefore it's the same trade as the minutes, any indications of progress towards consensus on the Framework Review. Serious progress towards consensus will make policy implementation more likely at the September meeting, the market would move now on that not in September.

For maximum dovish reaction would want to see both FG and AIT, FG and delayed AIT could be interesting, FG and no AIT could be viewed as hawkish potentially with YCC off the table. I'd want to watch how the market digests those final two scenarios as my conviction is a lot less. Any further QE would be welcomed as always, although that's not the big driver here.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.