Macro Menu: 17 - 21 August 2020

20 AUG 2020 | Careers

Amir Khadr - Head of Technology

A quick intro for anyone new to the 'Macro Menu'.

This weekly blog is intended to be a short 3-4 minute read covering the main fundamental drivers for the week ahead. My intention is to help identify and provide commentary on the current state of play and how they may influence markets across asset classes.

If you enjoy the read please feel free to share with your community!

This weekly blog is intended to be a short 3-4 minute read covering the main fundamental drivers for the week ahead. My intention is to help identify and provide commentary on the current state of play and how they may influence markets across asset classes.

If you enjoy the read please feel free to share with your community!

Happy anniversary!

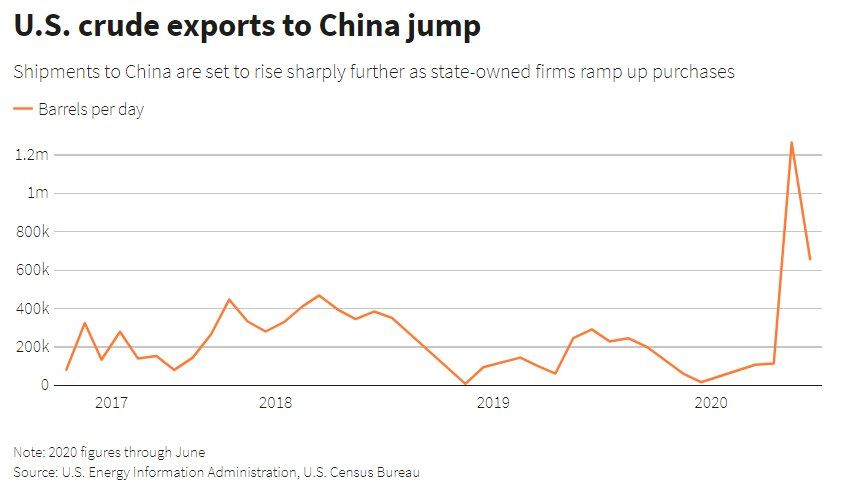

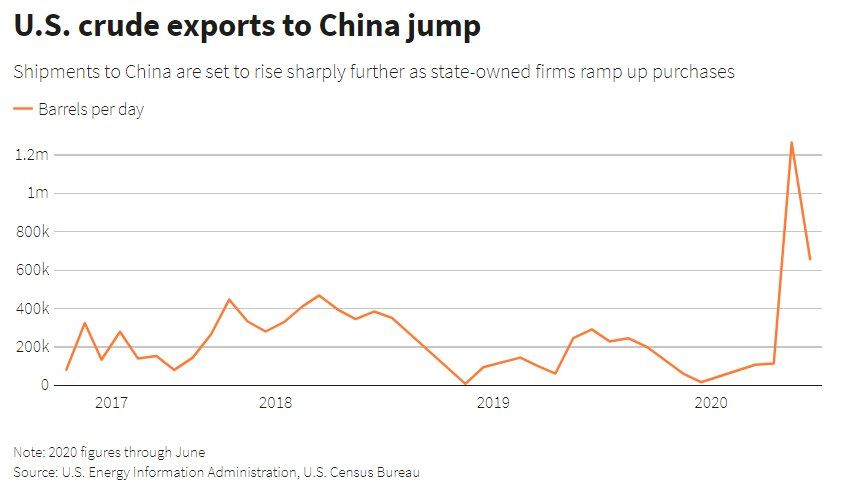

This Saturday was supposed to mark the 6-month anniversary of the phase 1 trade agreement signed in February between the US and China but at the last moment the review was delayed, citing scheduling conflicts and the need to allow more time for Chinese purchase of US exports.

At first, the abrupt cancellation of the meeting could be construed as a negative but when looking at the substantial pickup in Chinese imports over recent weeks it looks like the memo has been received in Beijing. On Friday, the U.S. Department of Agriculture reported the sale of 126,000 tonnes of soybeans to China, marking the eighth consecutive weekday with large sales to Chinese buyers, citing a Reuters exclusive.

Whether the change in trade has been due to the recent escalation in tech (TikTok, WeChat) and diplomacy (consolutes, H.K) or simply that China is in a more stable economic situation to resume the pre-defined agreement, the end result is that a compliance meeting would have been unproductive and a continuation of the recent pick up in trade will likely satisfy both political agendas for the time being.

As such, the weekend Dow via IG is flat and I would not expect a great deal of panic over the lack of formal dialogue this weekend with Trump likely to emphasise his tough stance is paying divided in that Chinese purchases from agricultural goods to energy products is picking up pace.

This Saturday was supposed to mark the 6-month anniversary of the phase 1 trade agreement signed in February between the US and China but at the last moment the review was delayed, citing scheduling conflicts and the need to allow more time for Chinese purchase of US exports.

At first, the abrupt cancellation of the meeting could be construed as a negative but when looking at the substantial pickup in Chinese imports over recent weeks it looks like the memo has been received in Beijing. On Friday, the U.S. Department of Agriculture reported the sale of 126,000 tonnes of soybeans to China, marking the eighth consecutive weekday with large sales to Chinese buyers, citing a Reuters exclusive.

Whether the change in trade has been due to the recent escalation in tech (TikTok, WeChat) and diplomacy (consolutes, H.K) or simply that China is in a more stable economic situation to resume the pre-defined agreement, the end result is that a compliance meeting would have been unproductive and a continuation of the recent pick up in trade will likely satisfy both political agendas for the time being.

As such, the weekend Dow via IG is flat and I would not expect a great deal of panic over the lack of formal dialogue this weekend with Trump likely to emphasise his tough stance is paying divided in that Chinese purchases from agricultural goods to energy products is picking up pace.

The awakening of 'Sleepy Joe'

The Democratic Convention 2020 kicks off on Monday and will last for four straight days. For those interested you can access a full media agenda HERE.

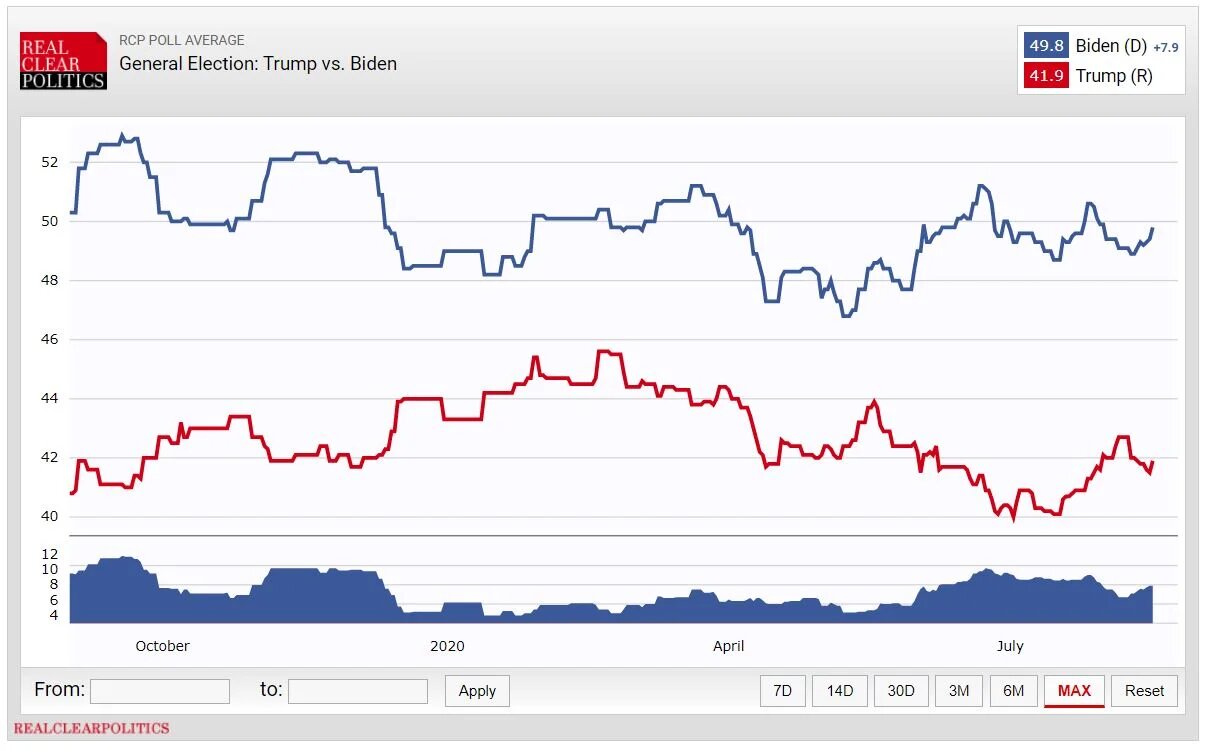

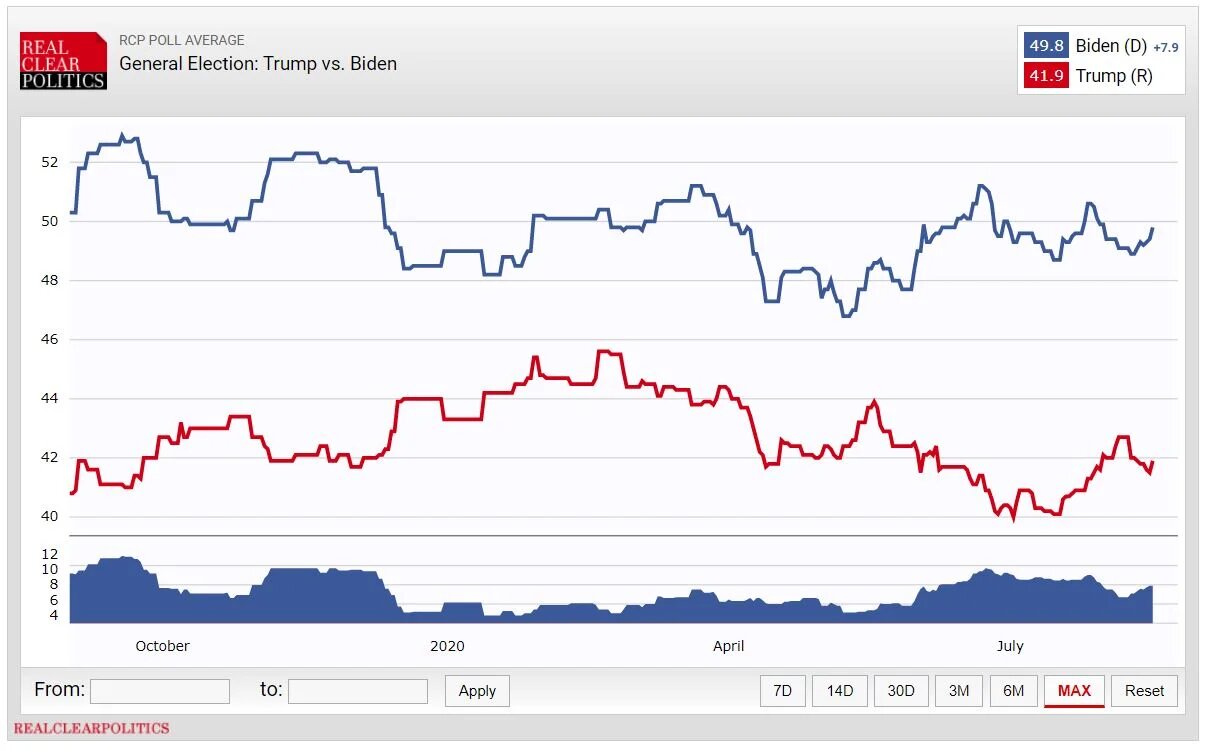

Since the appointment of Kamala Harris, Biden's polling has improved slightly with the RCP average poll re-widening to 7.9 from 6.4 this time last week. Newsquawk highlights that analysts believe this impact may be further exacerbated by convention week where increased air time and news coverage usually bumps candidates' polling.

The Democratic Convention 2020 kicks off on Monday and will last for four straight days. For those interested you can access a full media agenda HERE.

Since the appointment of Kamala Harris, Biden's polling has improved slightly with the RCP average poll re-widening to 7.9 from 6.4 this time last week. Newsquawk highlights that analysts believe this impact may be further exacerbated by convention week where increased air time and news coverage usually bumps candidates' polling.

For those interested, FiveThirtyEight released their 2020 US election forecast this week via the infamous statistician Nate Silver who has simulated the election 40,000 times to see who wins most over a multitude of complex variables.

Rather than go into the methodology and its findings in more detail the main page to bookmark with all the relevant graphics can be found HERE with an accompanying explainer video below.

Rather than go into the methodology and its findings in more detail the main page to bookmark with all the relevant graphics can be found HERE with an accompanying explainer video below.

The model has Biden with a commanding but not decisive advantage in the electoral college, but interestingly when looking at a sample of 100 outcomes, it punches out a score almost identical to its prediction of Clinton winning the 2016 election (71/29) and we know what happened there!

More on this over the coming weeks and months but despite all the mathematics behind generating such scenarios, my gut feeling remains that Trump will secure a 2nd term come November.

Make or break

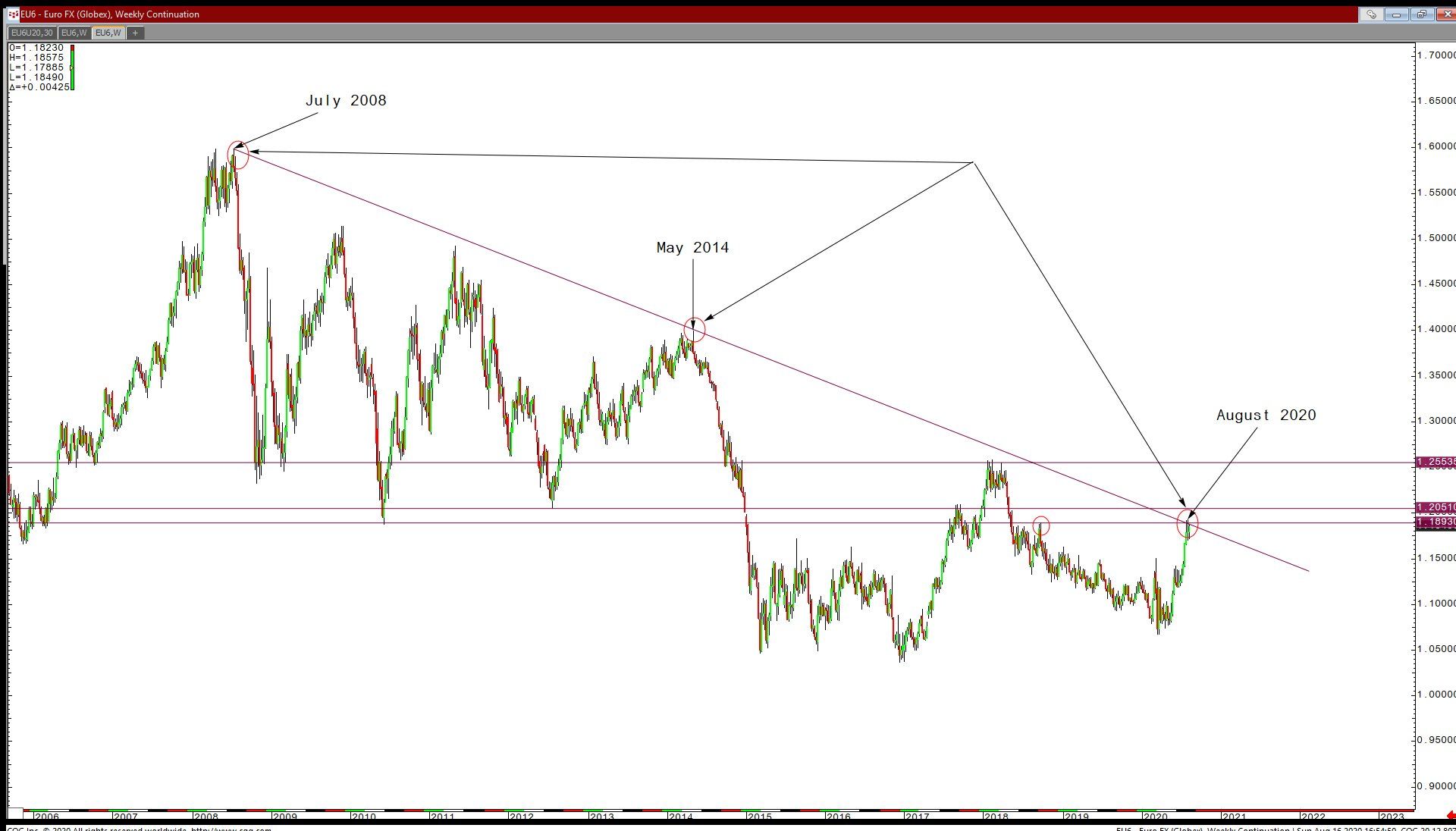

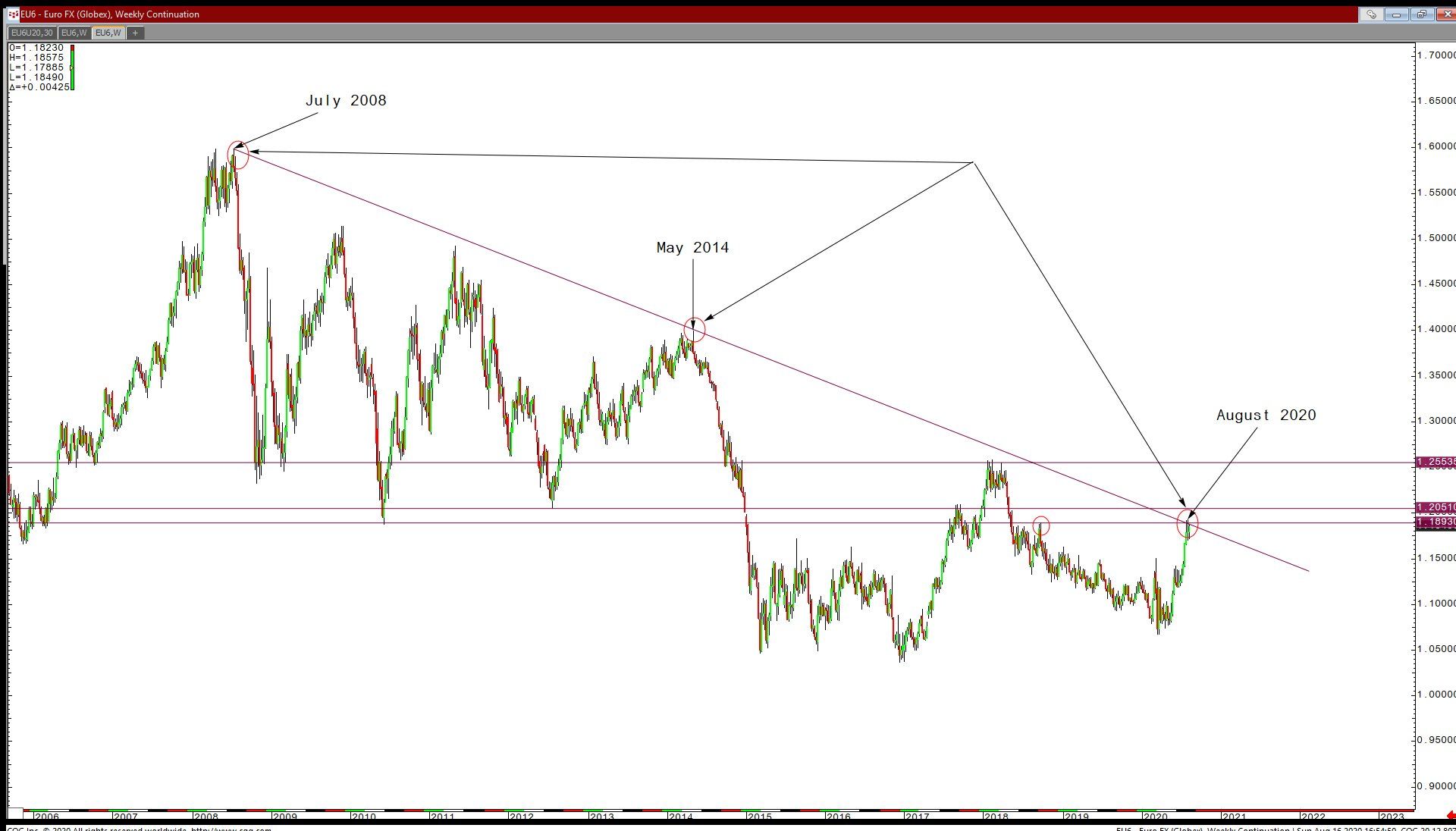

A number of the major USD pairs (EUR/USD, AUD/USD) have been trading in close proximity to important long-term trend lines and this week could be the deal breaker for either the bulls or the bears short-term.

More on this over the coming weeks and months but despite all the mathematics behind generating such scenarios, my gut feeling remains that Trump will secure a 2nd term come November.

Make or break

A number of the major USD pairs (EUR/USD, AUD/USD) have been trading in close proximity to important long-term trend lines and this week could be the deal breaker for either the bulls or the bears short-term.

The reason for this lies mainly with the release of the FOMC minutes this Wednesday with analysts at ING noting that any suggestion of impending Average Inflation Targeting (AIT) or Yield Curve Control (YCC) would be a dollar negative.

Details on these points are not guaranteed as the meeting itself was fairly vanilla and if the minutes echo that sentiment then attention will shift to the Jackhole Economic Symposium on August 27-28, which comes ahead of the Fed meeting on the 16th September. At present, my view is that the latter will be where the real substance emerges as the Fed will feel more comfortable unveiling enhanced forward guidance alongside their scheduled update on the economic projections.

On the other side of the currency trade is the EUR, which this week could well get an added boost from the release of the latest PMI data on Friday whereby a continuation of recent improvements is expected, while UK Retail Sales (Friday) should show only minor gains M/M (Exp. 2.3%) as pent up demand dissipates and consumers remain COVID conscience after last month's record increase.

For a more extensive rundown you can catch my daily market briefings on the Amplify Trading YouTube channel and via Twitter @AWMCheung.

Details on these points are not guaranteed as the meeting itself was fairly vanilla and if the minutes echo that sentiment then attention will shift to the Jackhole Economic Symposium on August 27-28, which comes ahead of the Fed meeting on the 16th September. At present, my view is that the latter will be where the real substance emerges as the Fed will feel more comfortable unveiling enhanced forward guidance alongside their scheduled update on the economic projections.

On the other side of the currency trade is the EUR, which this week could well get an added boost from the release of the latest PMI data on Friday whereby a continuation of recent improvements is expected, while UK Retail Sales (Friday) should show only minor gains M/M (Exp. 2.3%) as pent up demand dissipates and consumers remain COVID conscience after last month's record increase.

For a more extensive rundown you can catch my daily market briefings on the Amplify Trading YouTube channel and via Twitter @AWMCheung.

CALENDAR HIGHLIGHTS VIA @NEWSQUAWK

Monday

Tuesday

Wednesday

Thursday

Friday

Monday

- Data: Japanese GDP, US NY Fed Manufacturing

- Events: US Democratic National Convention (17th-20th) & BoC Senior Loan Officer Survey

- Speakers: Fed’s Bostic

- Earnings: JD.com

Tuesday

- Data: US Building Permits & Housing Starts

- Event: RBA Minutes

- Speakers: ECB’s de Guindos

- Earnings: Walmart, Home Depot, Persimmon

- Supply: UK & Germany

Wednesday

- Data: Japanese Trade Balance, UK, EZ & Canadian CPI

- Events: FOMC Minutes & JMMC Meeting

- Earnings: Target. NVIDIA, Analog Devices

- Supply: UK, Germany & US

Thursday

- Data: US Initial/Continued Jobless Claims & Philadelphia Fed

- Events: ECB Minutes

- Speakers: Fed’s Daly

- Supply: France & US

Friday

- Data: Australian PMIs, EZ, UK & US Flash PMIs, UK & Canadian Retail Sales, EZ Consumer Confidence

- Event: UK & EU Chief Brexit Negotiators Meet

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.